Posts Tagged ‘appraisal process’

7 Questions Residential Appraisers Ask Homeowners

When purchasing a home with a mortgage or refinancing, the transaction may require that a home appraisal inspection be done. This is because appraisals assure the lender that they are not issuing mortgages for more than what residential properties are worth. Appraisals are conducted by real estate appraisers, who must meet an educational requirement and…

Read MoreHow to Get Accurate Property Comps

Property comparables, called “property comps” for short, play a significant role in the home appraisal process. Whether you are a seller, a buyer, a real estate agent, or a loan officer, using accurate property comps is essential for determining a listing price, financing for a mortgage loan, and assessing how much equity is in the…

Read MoreHow Appraisal Management Companies Aid the Appraisal Process

The home appraisal is a key part of any home sale transaction, assuring the lender that they are not issuing a mortgage for more than a property is worth. Lending regulations restrict the borrower, mortgage broker, or lender from choosing which appraiser conducts their home inspection and prevent direct communication between these parties. Appraisal management…

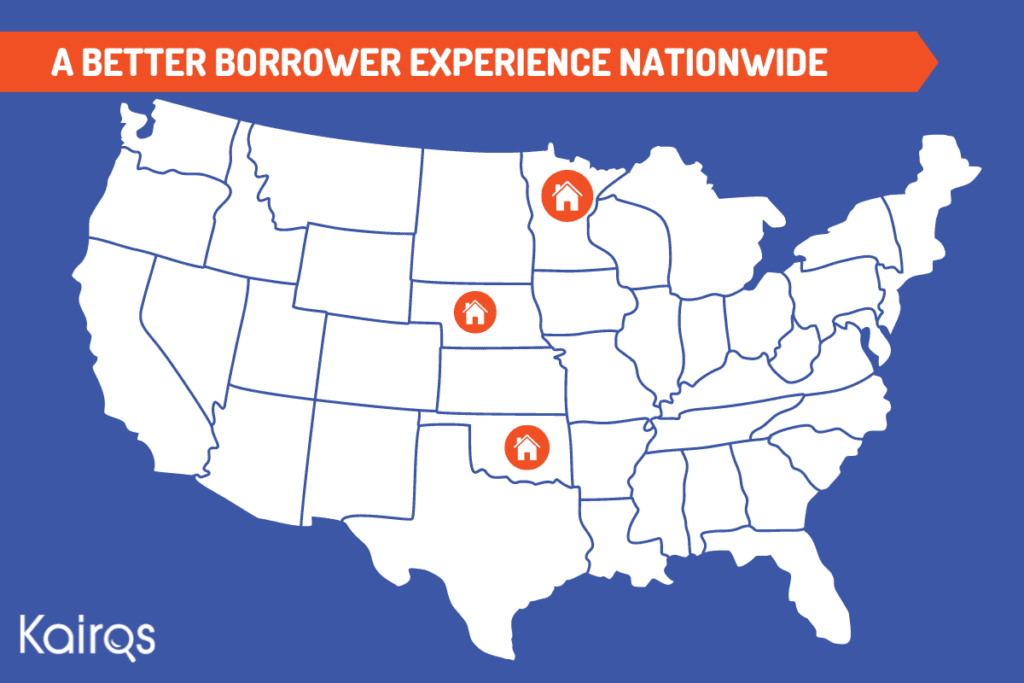

Read MoreKairos Appraisal Services Adds More States to Its Nationwide Roster

October 27, 2022—Kairos Appraisal Services has expanded its service footprint to include the states of South Dakota, Oklahoma, and Minnesota. Kairos Appraisal, a nationally recognized AMC, is now licensed in 42 states. The company is known and recognized for its work in revolutionizing the appraisal process. This tech includes pre-appraisal tools that help improve turn…

Read MoreSales Price vs. Appraisal Value: What’s the Difference?

When you sell or buy a home, the sales price and appraisal value don’t always match up, and this discrepancy can lead to a change in the purchase price or dissolve the deal altogether. Therefore, it’s essential to understand how these numbers can differ and how the sale can still proceed when there is a…

Read MoreUnderstanding the Home Appraisal Contingency

When buying a home, an appraisal contingency can serve as a safety net. If the home you want to purchase appraises for less than the price you agreed to pay, it gives you negotiating power with the seller. It also allows you to walk away from the deal without losing your deposit, should the seller…

Read MoreAppraisal Technology and the Future of the Appraisal Industry

While most mortgage brokers and lenders use financial technology (fintech), the same can’t be said for the appraisal industry. While a home loan can be processed in 10 days, the national average time to turn around a real estate appraisal is 17 to 20 days. The question then becomes, “How can the appraisal industry streamline…

Read MoreThe Challenges of Doing Multifamily Property Appraisals

Doing multifamily property appraisals can be very challenging because they aren’t done the same way as either single-family home or apartment building appraisals. In fact, a multifamily property appraisal is quite different from either. In part, this is because a multifamily property is most often used to produce income rather than as a place for…

Read MoreWhat COVID-19 Has Taught Us About Appraisals

The entire housing market has seen a lot in the past 18 months or so, and the appraisal industry is no exception. With all that’s happened since the COVID-19 pandemic started, we can all safely say that we’ve learned quite a bit. So, now the question is, what have we learned about the appraisal industry…

Read MoreWhat AMCs Do and Don’t Do in the Appraisal Process

Appraisal Management Companies (AMCs) are one of the newest additions to the real estate industry. AMCs were created from Dodd-Frank to separate mortgage brokers from appraisers, protect the market from inflated and/or biased values, and facilitate the entire appraisal process. In addition to managing the appraisal process, AMCs must also consider the perspectives and needs…

Read More