The ACE+ Property Data Report is a new component that could allow borrowers on Freddie Mac–eligible loans to avoid a full appraisal inspection on purchases or cash-out or rate-term refinances. Instead, property information is collected on-site by a real estate agent, inspector, or data collector using Freddie Mac’s proprietary PDR data sets.

When the ACE+ PDR option is accepted and a PDR is used to originate the mortgage, Freddie Mac will accept the guesstimated value submitted by the seller for underwriting the mortgage.

According to Freddie Mac: “Our goal is to purchase loans supported by the most reliable and appropriate valuation methods available that help mitigate risk associated with default. Including the PDR provides additional information about the condition of the subject property and allows lenders and borrowers to continue to benefit from originating loans without an appraisal while ensuring we purchase loans secured by properties in acceptable condition.”

ACE+ PDR Key Takeaways

Freddie Mac is still testing various components of its ACE+ PDR offering, and this bulletin outlines its current requirements and eligibility. Here are some of the key things to note:

- If a loan is eligible for ACE+ PDR, it will be indicated in the Loan Product Advisor® (Freddie Mac’s automated underwriting system) feedback certificate for new loan submissions on and after July 17, 2022.

- Mortgages that are eligible to receive an ACE+ PDR:

- Must be secured by a one-unit primary residence or second home, including units in a condominium project

- Must be a “no cash-out” or a cash-out refinance transaction

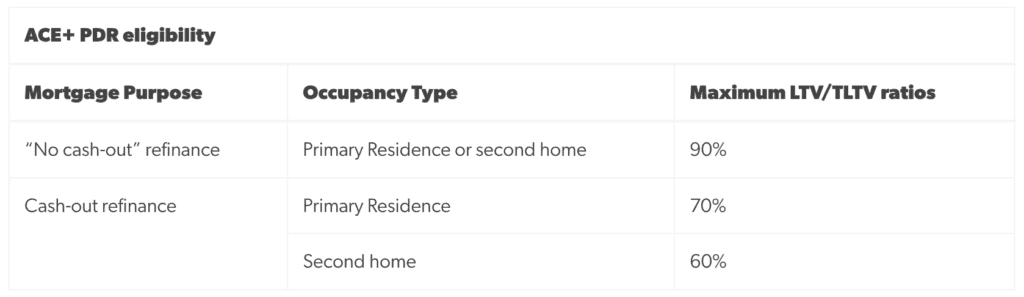

- Must meet the maximum LTV/TLTV ratio requirements in the following chart:

- The PDR must be completed through on-site data collection by a trained property data collector. Property data collectors can be non-appraisers, appraisers, or appraiser trainees who meet certain requirements and have the appropriate qualifications.

For more information on the ACE+ PDR offer, review the ACE+ PDR FAQs.

Kairos Appraisal uses trained data collectors to provide ACE property data reports that support the Freddie Mac PDR data set. However, it’s important to understand that there are both rewards and risks to the ACE+ PDR offer.

What Are the Rewards?

There are two main advantages of the ACE+ PDR offering: lower costs and faster turn times.

The national average for a traditional property appraisal in the U.S. is $400 to $550, and appraisal fees vary based on the home’s size, location, features, and condition. In comparison, the cost to determine an opinion of value for a PDR can range from $200 to $350.

With a PDR, the assumption is that mortgages can be closed more quickly because the process for completing the PDR is less cumbersome than a full appraisal process. The ACE+ PDR is a form developed by Freddie Mac that consists of mostly “checkbox” entries, photos, a floor plan, and a few sections to add comments. However, a physical inspection of the property is still required, which is often regarded as the most cumbersome piece of an appraisal.

A residential home appraisal requires an on-site property examination conducted by a licensed appraiser, who also considers the recent sale prices of comparable homes in the area and other data points to determine the value of the home.

Then the appraiser creates the appraisal report to justify the home’s appraised value with detailed adjustments to the comparable sales. Most appraisals can be completed in a few days to a week, depending on various factors. (Kairos Appraisal Services delivers completed appraisal reports in less than five business days on average in 42 states.)

What Are the Risks?

The risk associated with the ACE+ PDR is that this report does not actually determine the value of the home. If the home value is estimated inaccurately, it could pose a risk to the borrower, the lender, and the economy.

A PDR does not require facilitation by a licensed appraiser, so it is considered less reliable than an appraisal. Because of this, lenders may still require a full appraisal. In real estate, appraisals are a critical component of the mortgage process because they ensure that the borrower is not financing more than the home is potentially worth.

An appraisal also confirms to the mortgage lender that it’s not lending more than the home is worth or over-lending with products like home equity loans or a home equity line of credit.

How Kairos’ Pre-Appraisal Tools Align with the Loan Process

As appraisal reporting plays a crucial role in any real estate transaction, the appraisal process hasn’t been able to keep up with the speed of the mortgage loan process—until now. At Kairos, we’ve been able to bridge that gap with Pocket Appraisal, amazing customer service, unmatched communication, and the other pre-appraisal tools we provide.

The best part about our appraisal tool chest is that licensed appraisers facilitate the valuations, so the home values are accurate and based on current market data. This protects all parties involved, including the client borrower, loan officer, and lender. Learn more about how Kairos Appraisal leverages technology and data analytics to bring the appraisal process up to speed and current with today’s loan process. Our 4.9-star average customer rating is a tribute to our customer service, technology, and talented team. For more information about the appraisal process, click here to read additional articles.