Posts by Alex Todak

6 Factors That Impact a Home’s Appraised Value

Are you ready to put your house on the market and sell your home? You may wonder how your real estate agent arrived at a sales price and what factors influence your home’s appraised value. Whether you are delightfully surprised or disappointed in the pricing recommendation, it’s helpful to understand how homes are valued. While…

Read MoreUnderstanding the Different Types of Home Appraisals

If you have plans for home buying, selling, or refinancing, it will likely require an appraisal. While the mortgage lender will order the appraisal to ensure that they are not issuing a loan for more than what the property is worth, it’s still best for buyers and sellers to understand the home appraisal process and…

Read More5 Things Real Estate Appraisers Want You to Know

Wouldn’t it make things so much easier if there was a blog containing all the things residential appraisers want sellers to know about their home appraisals? We thought so too, because here it is! That’s right, we’re unveiling all the mysteries. (Well, maybe not all of them—you wouldn’t need us if you already knew everything.)…

Read MoreWhat Is a Reconsideration of Value for an Appraisal Report?

The cooling housing market is forecast to continue in 2023, and buyers and sellers are proceeding with caution. With increased interest rates and declining home sales, there’s plenty to be nervous about—and there’s still the home appraisal, which can derail any mortgage deal if it comes in “low.” The good news is that a reconsideration…

Read More7 Questions Residential Appraisers Ask Homeowners

When purchasing a home with a mortgage or refinancing, the transaction may require that a home appraisal inspection be done. This is because appraisals assure the lender that they are not issuing mortgages for more than what residential properties are worth. Appraisals are conducted by real estate appraisers, who must meet an educational requirement and…

Read MoreHow to Get Accurate Property Comps

Property comparables, called “property comps” for short, play a significant role in the home appraisal process. Whether you are a seller, a buyer, a real estate agent, or a loan officer, using accurate property comps is essential for determining a listing price, financing for a mortgage loan, and assessing how much equity is in the…

Read MoreHow Appraisal Management Companies Aid the Appraisal Process

The home appraisal is a key part of any home sale transaction, assuring the lender that they are not issuing a mortgage for more than a property is worth. Lending regulations restrict the borrower, mortgage broker, or lender from choosing which appraiser conducts their home inspection and prevent direct communication between these parties. Appraisal management…

Read MoreThe Risks and Rewards of ACE+ PDRs

The ACE+ Property Data Report is a new component that could allow borrowers on Freddie Mac–eligible loans to avoid a full appraisal inspection on purchases or cash-out or rate-term refinances. Instead, property information is collected on-site by a real estate agent, inspector, or data collector using Freddie Mac’s proprietary PDR data sets. When the ACE+…

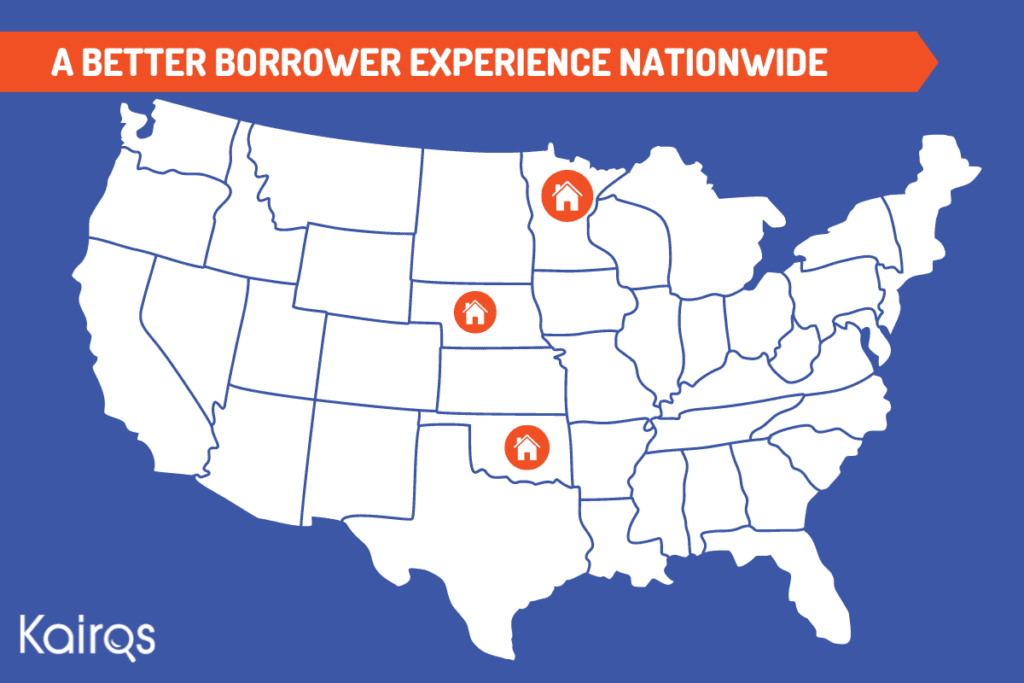

Read MoreKairos Appraisal Services Adds More States to Its Nationwide Roster

October 27, 2022—Kairos Appraisal Services has expanded its service footprint to include the states of South Dakota, Oklahoma, and Minnesota. Kairos Appraisal, a nationally recognized AMC, is now licensed in 42 states. The company is known and recognized for its work in revolutionizing the appraisal process. This tech includes pre-appraisal tools that help improve turn…

Read MoreHow Pre-Appraisal Tools Improve the Home Appraisal Process

If you’re a mortgage loan officer and not taking advantage of pre-appraisal tools, your clients could be paying the price with higher fees and longer turnaround times. Read on to learn why pre-appraisal tools are the perfect solution for providing a better borrower experience and, for loan officers, how these tools can expedite the process…

Read More